With the November presidential election 24 weeks away, an index measuring consumer sentiment on the economy dropped to a six-month low after its largest decline since 2021.

The plummeting confidence comes as President Joe Biden recently shrugged off the concerns while falsely claiming for the second time in less than a week that inflation was at 9% when he took office.

On Sunday, The Washington Post reported that the index of consumer sentiment, which measures the economic perceptions of Americans, dropped sharply amid nagging inflation and rising gas prices. In April, inflation remained well above the Federal Reserve’s target of 2%, hitting 3.4%. While the number is well below the high of 9.1% that was reached in June of 2022, inflation has remained above 3% every month since last summer.

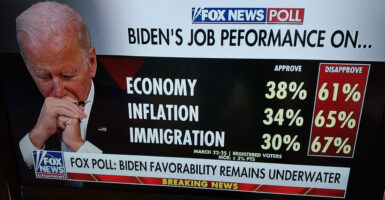

Economic concerns have consistently ranked as the top issue for American voters ever since 2021, when inflation began rising steadily due to a massive uptick in government spending enacted by the Biden administration. A Gallup survey released at the end of March revealed that inflation was the top most worrisome issue for Americans, followed closely by immigration.

The price of consumer goods also continues to rise. Last week, the latest consumer price index summary was released, revealing that the price of all goods rose 0.3% in April, having risen 3.4% over the past 12 months. Overall energy prices rose 2.6% in the past 12 months, while food prices saw an increase of 2.2% in the last year.

Meanwhile, gas prices have also remained consistently high. With a current average price of $3.61 per gallon, gas has shot up 50 cents since the start of the year. Under the Biden administration, the average price of gas has fluctuated wildly, reaching a peak of over $5 a gallon at the start of 2022.

The current average price per gallon remains over 60 cents higher than it was when President Donald Trump left office in January 2021.

Popular companies such as McDonald’s, Home Depot, Under Armour, and Starbucks have recently reported underwhelming earnings due to increasingly modest consumer spending with few signs that the economic outlook will improve any time soon. In addition, Walmart, Target, and discount grocer Aldi have recently begun slashing prices of goods in hopes of attracting more business.

“We continue to feel the impact of a more cautious consumer,” said Starbucks CEO Laxman Narasimhan last month. “Many customers are being more exacting about where and how they choose to spend their money, particularly with stimulus savings mostly spent.”

Notably, some Biden administration officials are beginning to acknowledge the financial struggles and low consumer confidence of ordinary Americans after the president appeared to dismiss them earlier this month, claiming that “[w]e’ve already turned [the economy] around.”

“Families are still struggling with prices that are too high,” admitted Jared Bernstein, chairman of Biden’s Council of Economic Advisers. “We’ve made a lot of progress in the right direction, and we are going to keep fighting to lower costs for families and make billionaires and corporations pay their fair share.”

A spokeswoman for the Trump campaign remarked that the 45th president would “uplift all Americans” by reducing taxes and increasing wages. “The American people cannot afford four more years of Bidenomics.”

In comments to The Washington Stand, Oliver McPherson-Smith, director of the Center for Energy & Environment at the America First Policy Institute, contended that consumers have little reason to be confident in America’s economic outlook under Biden.

“It’s no surprise that consumers across the country are feeling pessimistic about the economy,” he observed. “Bidenomics means overregulation and prolific spending—both of which drive up consumer prices. Under Bidenomics, household energy costs are on average 22% higher than under President Trump’s America First policies. Gas prices are up on average 39.7%.”

McPherson-Smith continued, “The May measurement of the University of Michigan’s index of consumer sentiment is a searing indictment of the Biden administration’s economic mismanagement. Even during the uncertainty of the early pandemic months, at no point during the Trump administration were American consumers this pessimistic about the economy.”

Michael Faulkender, chief economist at the America First Policy Institute, further expanded on the repercussions that rising inflation has incurred on American pocketbooks.

“The Bidens will keep blaming everyone but themselves for the inflation devastating Americans’ budgets,” he told The Washington Stand. “As published recently in Bloomberg, if one looks at inflation-adjusted disposable income—how far paychecks go in purchasing-power terms—it rose 12% under Trump and is at 3% under Biden. Once you incorporate the effect of interest-rate increases on anyone borrowing money to buy a car, home, or place a purchase on their credit card, Americans are worse off. Those effects are even greater for the most vulnerable in our society.”

“No amount of deflection, demagoguery, or gaslighting will alter the economic harm the American people have suffered under the far-left policies of the Biden administration,” Faulkender concluded.

Originally published at WashingtonStand.com