Resistance to environmental, social, and corporate governance investing is taking center stage in a number of Republican-leaning state legislative sessions this year. The question is how red states can prevent asset managers from investing their states’ funds—or exercising shareholder rights (such as proxy voting)—to advance ESG-related political and social goals rather than maximizing returns for beneficiaries.

There are currently two similar pieces of model legislation designed for states to achieve this goal—the American Legislative Exchange Council’s State Government Employee Retirement Protection Act and The Heritage Foundation’s State Pension Fiduciary Duty Act. To date, legislators in six states have introduced fiduciary-duty legislation, and at least as many more are expected to do so soon.

This is not an arcane legal issue. Millions of Americans work for state and local governments; most of those workers depend on their state pensions for support in retirement. Their pensions are largely funded by returns on the investments that asset managers make on their behalf.

Maximizing those returns is critical as unfunded state-pension liabilities total over $8 trillion, according to an ALEC analysis from last June. It’s difficult enough to maximize those returns; when other objectives take priority, it is close to an economic certainty that returns will suffer.

That is why the law has long required that those investing funds on behalf of others focus solely on the financial interests of the beneficiaries of such funds. However, what that means in practice can be less clear than one might assume.

For example, does a state pension fund asset manager violate its fiduciary duty by investing in a company and then pressuring it to reduce its carbon emissions if doing so will lower that company’s profits and the pension fund’s returns?

Last August, 19 red-state attorneys general took the position that it was a violation. In a letter to Larry Fink, the CEO of BlackRock (the world’s largest asset manager), the attorneys general stated that investor returns must be a fiduciary’s sole focus and that BlackRock was sacrificing those returns to advance its “net-zero” carbon emissions agenda.

Shortly thereafter, 14 blue-state financial officers launched a website taking the exact opposite position, supporting BlackRock and criticizing red states for failing to acknowledge long-term risks or that “climate change is real.” For its part, BlackRock responded that its actions were “entirely consistent with [its] fiduciary obligations.”

ALEC’s and The Heritage Foundation’s legislative models were designed to clarify situations such as this. Addressing ESG investing directly, the models make it clear that the “sole interest” rule prohibits fiduciaries responsible for the management of state funds from managing those funds in a way designed to further “non-pecuniary, environmental, social, political, ideological, or other goals or objectives.”

To put an even finer edge on it, the models restrict consideration of events that “involve a high degree of uncertainty regarding what may or may not occur in the distant future” and “are systemic, general, or not investment-specific in nature”—say, for example, climate change and the assumption that net-zero emissions goals will mitigate it.

These models would (subject to certain conditions) also withdraw proxy-voting authority from all outside asset managers to ensure that shares of stock purchased with state funds are voted in the sole interest of the pension fund’s beneficiaries rather than to advance ESG or other nonfinancial goals.

Reducing the massive share-voting influence of ESG-supporting asset managers such as BlackRock, State Street, and Vanguard (which, combined, own on average 20% of every company in the S&P 500) would reduce their ability to elect directors or support activist-shareholder resolutions.

It also would reduce the influence of the so-called stewardship programs they employ to pressure companies in which they invest to adopt ESG-related policies without a formal proxy vote. The fewer shares you can vote for, the less pressure you can exert.

Of course, not every state has the administrative support necessary to knowledgeably vote its shares, given the hundreds of companies and the thousands of director nominees and shareholder resolutions involved. Many states will likely opt to retain proxy advisory firms.

The problem is that two proxy advisory firms (ISS and Glass Lewis) control 97% of the market, and both are supporters, if not advocates, of ESG.

Earlier this month, 21 red-state attorneys general sent a letter to both ISS and Glass Lewis stating that these firms’ commitments to ESG have potentially put them in breach of their contractual obligations and in violation of state and federal law. The letter provides “evidence of these potential breaches” with respect to the firms’ “climate and diversity, equity, and inclusion priorities.” It seeks “written assurance that [they] will cease such violations and commit to following the law.”

ALEC’s and The Heritage Foundation’s models address this issue by requiring that state pension funds hire only a proxy advisory firm that has “a practice of, and in writing commits to, follow[ing] proxy voting guidelines” that are consistent with the fiduciary obligation to act solely upon financial factors.

These two models offer much-needed protection for state-pension beneficiaries, most of whom merely want a comfortable retirement after years of public service.

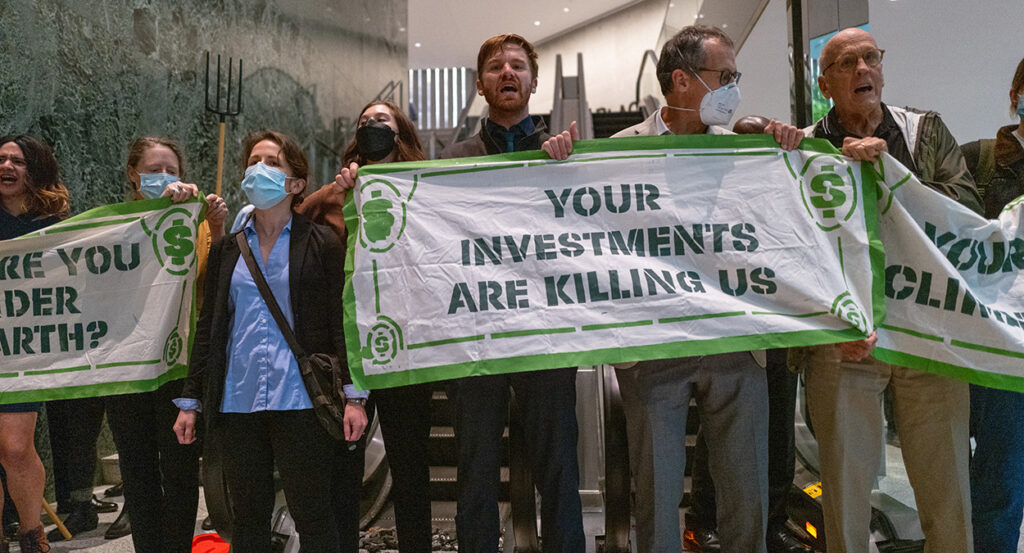

This will certainly meet resistance from those who would use other people’s money to pursue policy goals. If the Left wants to change the world, it should do so at the ballot box—or with its own money.

This article was originally published in National Review.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.