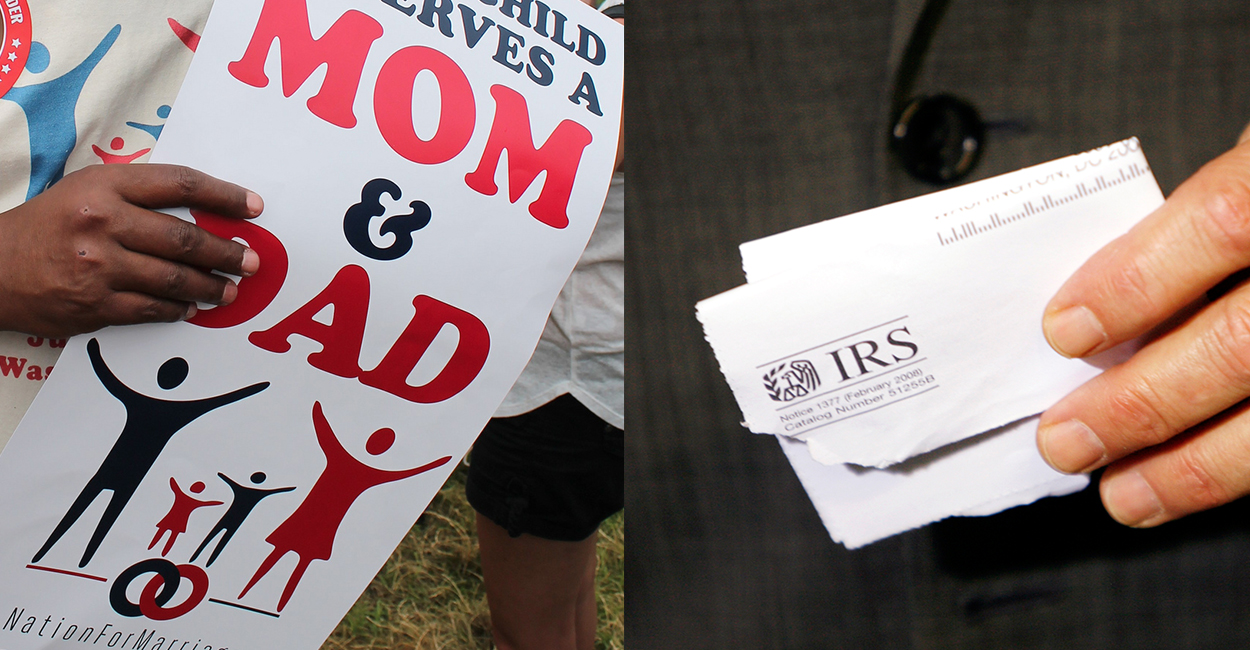

Two years after activists for same-sex marriage obtained the confidential tax return and donor list of a national group opposed to redefining marriage, the Internal Revenue Service has admitted wrongdoing and agreed to settle the resulting lawsuit.

The Daily Signal has learned that, under a consent judgment today, the IRS agreed to pay $50,000 in damages to the National Organization for Marriage as a result of the unlawful release of the confidential information to a gay rights group, the Human Rights Campaign, that is NOM’s chief political rival.

“Congress made the disclosure of confidential tax return information a serious matter for a reason,” NOM Chairman John D. Eastman told The Daily Signal. “We’re delighted that the IRS has now been held accountable for the illegal disclosure of our list of major donors from our tax return.”

The Daily Signal is seeking comment on the settlement from the IRS and Justice Department.

Update: At 5:28 p.m, IRS spokesman Bruce I. Friedland emailed: “Privacy law, specifically Section 6103 of the Internal Revenue Code, prohibits us from commenting.”

In his order entered this morning, District Court Judge James C. Cacheris granted the settlement of NOM’s suit against the IRS, which was represented by the Department of Justice.

>>> Commentary: Why We March for Marriage

In February 2012, the Human Rights Campaign posted on its web site NOM’s 2008 tax return and the names and contact information of the marriage group’s major donors, including soon-to-be Republican presidential nominee Mitt Romney. That information then was published by the Huffington Post and other liberal-leaning news sites.

HRC’s president at the time, Joe Solmonese, was tapped that same month as a national co-chairman of President Barack Obama’s re-election campaign.

Eastman said an investigation in the civil lawsuit determined that someone gave NOM’s tax return and list of major donors to Boston-based gay rights activist Matthew Meisel. Email correspondence from Meisel revealed that he told a colleague of “a conduit” to obtain the marriage group’s confidential information.

Testifying under oath in a deposition as part of the lawsuit filed in U.S. District Court for the Eastern District of Virginia, Meisel invoked his Fifth Amendment right not to incriminate himself and declined to disclose the identity of his “conduit.”

To get at that fact, Eastman said, the National Organization for Marriage has asked Attorney General Eric Holder to grant immunity from prosecution to Meisel.

The $50,000 to be paid by the IRS represents actual damages NOM incurred responding to the illegal disclosure, not punitive damages, since the marriage group was unable to prove disclosure of the confidential records was deliberate after Meisel took the Fifth.

Meisel provided the marriage group’s tax data to the Human Rights Campaign, documents found as part of the investigation show. HRC is among organizations and activists advocating same-sex marriage that routinely describe NOM as a “hate group” or “anti-gay” for making the case for preserving marriage as the union of one man and one woman.

>>> Commentary: The Bullies’ America

“We urge other groups that have suffered similar problems with the IRS to keep pressing until they, too, are fully vindicated,” Eastman said.

Eastman was referring to ongoing congressional probes and lawsuits over IRS targeting of tea party and other conservative groups that sought tax-exempt status.

In a draft press release on the settlement and admission by the IRS of wrongdoing, Eastman said:

It has been a long and arduous process to hold the IRS accountable for their illegal release of our confidential tax return and donor list, which was ultimately given to our chief political rival by the recipient. In the beginning, the government claimed that the IRS had done nothing wrong and that NOM itself must have released our confidential information. Thanks to a lot of hard work, we’ve forced the IRS to admit that they in fact were the ones to break the law and wrongfully released this confidential information.

Eastman, a lawyer and law professor, also is a member of the ActRight Legal Foundation team that brought the lawsuit against the federal government and the IRS on NOM’s behalf in October 2013. He said at the time that the Human Rights Campaign removed “redaction layers” from the electronic documents showing they originated at the IRS.

In May 2012, Eastman and NOM President Brian Brown asked the Department of Justice to investigate and prosecute the case. Eastman appeared last June before the House Committee on Ways and Means to testify about the illegal disclosure o the marriage group’s donors.

Unauthorized disclosure of confidential tax information is a felony offense that can result in five years in prison, but the Department of Justice did not bring criminal charges.

“We urge the Congress to explore this issue with the appropriate government officials,” Eastman said. “It’s imperative that all those who have engaged in corrupt practices and illegal acts in the IRS be identified and held accountable.”

>>> Watch Recap of March for Marriage