The release of today’s Congressional Budget Office (CBO) report on the long-term budget outlook sends one message loud and clear: The U.S. spending and debt crisis is only getting worse.

U.S. public debt doubled since before the recession and stands at a 50-year high today. The American public has not seen public debt levels this high since around World War II. While President Obama’s favorite talking point on the deficit is that it “has been cut in half since 2009,” he makes no mention of the real record-breaker under his term. According to the CBO:

Between 2009 and 2012, the federal government recorded the largest budget deficits relative to the size of the economy since 1946, causing federal debt to soar. Federal debt held by the public is now about 73 percent of the economy’s annual output, or gross domestic product (GDP). That percentage is higher than at any point in U.S. history except a brief period around World War II, and it is twice the percentage at the end of 2007 (emphasis added).

Even though there is a short-term reduction in the deficit as a percentage of GDP through 2015, this reduction is fleeting. Spending growth is projected to accelerate as Obamacare takes off and more and more baby boomers begin drawing benefits from Social Security, Medicare, and Medicaid.

Already 45 percent of all federal spending goes toward those three major entitlements, up from 25 percent a little over a decade ago. By 2023, half of all spending will be automatically directed toward these entitlements. Moreover, the cost of servicing the debt is expected to rise sharply.

The CBO lists these drivers of increasing spending over the next decade:

CBO expects interest rates to rebound in coming years from their current unusually low levels, sharply raising the government’s cost of borrowing. In addition, the pressures of an aging population, rising health care costs, and an expansion of federal subsidies for health insurance would cause spending for some of the largest federal programs to increase relative to GDP.

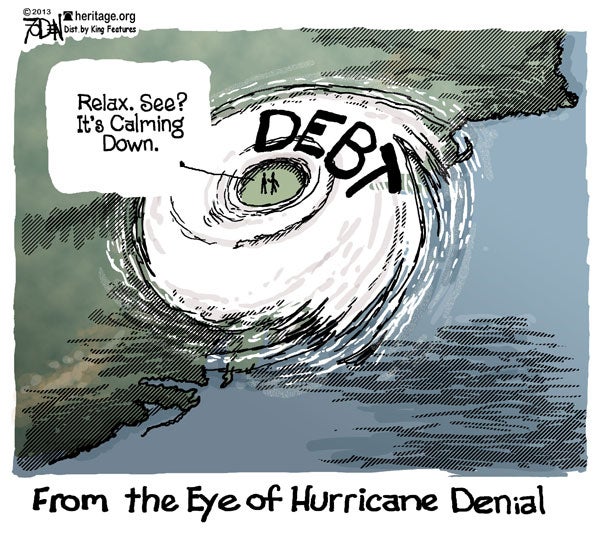

Yet President Obama doesn’t seem to think that resolving the worsening spending and debt crisis is urgent at all. He has said so many times.

Before his re-election, Obama told David Letterman that “we don’t have to worry about [the debt] short term.”

During fiscal cliff negotiations in December, the President got annoyed with hearing about the spending crisis, and the following exchange happened with House Speaker John Boehner (R–OH):

Boehner: “Clearly we have a health-care problem, which is about to get worse with ObamaCare. But, Mr. President, we have a very serious spending problem.”

Obama: “I’m getting tired of hearing you say that.”

Then again, just last March, just 2 months before hitting the $16.7 trillion debt limit on May 19, President Obama repeated the sentiment on the show Good Morning America. “We don’t have an immediate crisis in terms of debt.”

Most recently at an August town hall event, President Obama said the same thing: “We don’t have an urgent deficit crisis. The only crisis we have is the one that is manufactured in Washington and it’s ideological.”

Given President Obama’s expressed interest in even more federal spending, it is no surprise the President has denied the urgency of the debt crisis. But for the rest of the country, CBO’s facts about the budget outlook speak louder. Congress needs to cut spending and reform entitlement programs—and do so now.