Two years ago today, Standard & Poor’s downgraded the U.S. credit rating—and it hasn’t recovered since.

Then, the downgrade came because the President and Congress failed to resolve the long-term spending and debt crisis. Now, the situation is even worse. Congress and the President should rein in out-of-control spending and reform the entitlements before, or as part of, any increase in the debt ceiling this fall.

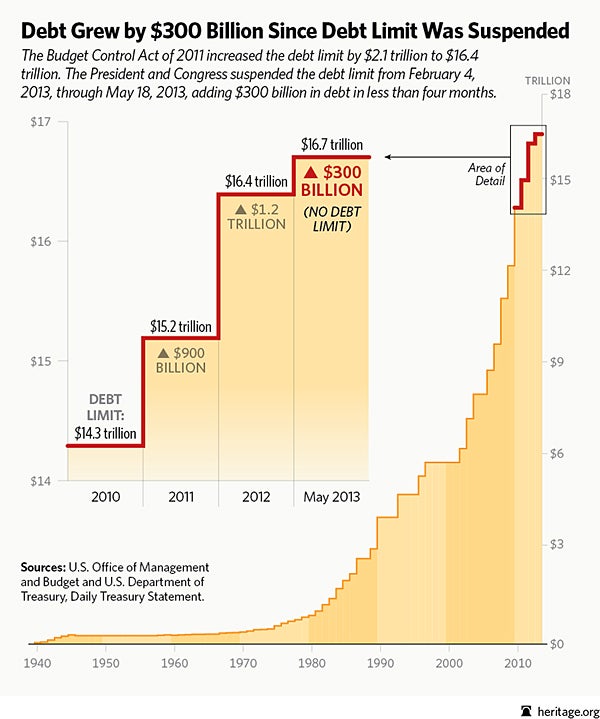

In 2011, S&P downgraded the U.S.’s credit rating—S&P’s estimation of the U.S.’s ability to repay the massive amount of debt it has compiled and will continue compiling—a few days after Congress and the President agreed to the Budget Control Act, which raised the debt ceiling by at least $2.1 trillion in exchange for equal spending reductions to be made over 10 years.

A lesser credit rating eventually means investors would require a higher interest rate to purchase U.S. government debt. A higher borrowing cost for the U.S. government would drive spending even higher and exacerbate our already deeply troubling deficit and debt situation. The Budget Control Act’s approach—to offset any increase in the debt ceiling with spending reductions of equal size—was a workable compromise at the time and contained a slight chance of arriving at entitlement reforms through a so-called supercommittee.

The supercommittee was a 12-member panel evenly divided between Democrats and Republicans with the charge of identifying $1.2 trillion in spending reductions—or else sequestration would kick in. Though the Budget Control Act allows spending and debt to continue to grow indefinitely, it at least forced some semblance of fiscal discipline.

But the Budget Control Act did nowhere near enough, and the supercommittee failed miserably. The act reduces only one-third of the U.S. federal budget: discretionary spending, which includes defense and non-defense programs. The spending reductions are poorly targeted and were set up in such a way as to assure constant conflict in Congress. They threaten the nation’s defense capabilities the most.

Meanwhile, the key drivers of out-of-control spending and growing debt continue expanding rapidly: Medicare, Medicaid, and Social Security already consume 45 percent of the budget and are growing fast. Obamacare accelerates the entitlement spending explosion. The Budget Control Act leaves these programs nearly untouched, keeping the U.S. on a fiscal crisis course.

When Standard & Poor’s downgraded the U.S. credit rating in 2011, the ratings agency clearly stated that the deficit-reduction measure Congress and the President agreed to fell far short of correcting the U.S. fiscal course. Moody’s, another big-three ratings agency (Fitch Group is the third), warned recently that further fiscal consolidation was necessary to avoid deficits growing too big again in the future, which could hurt the U.S. rating.

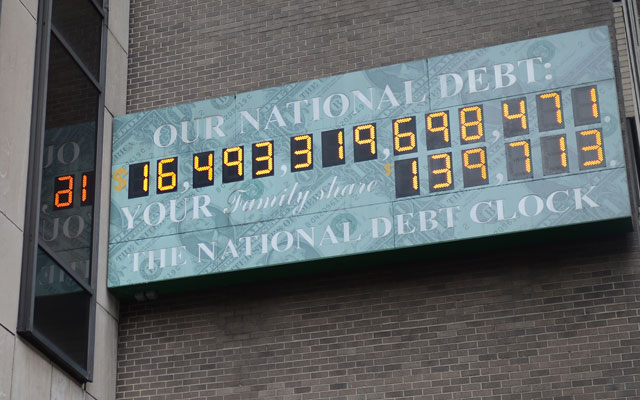

Today marks the second anniversary of the U.S. credit downgrade by S&P of a rating the U.S. had held for 70 years, and our nation’s spending and debt problem has only gotten worse. The U.S. hit its statutory debt ceiling in May with a debt that’s bigger than the entire U.S. GDP at $16.7 trillion. Treasury is borrowing from accounts that are not subject to the debt limit to continue spending that exceeds revenues, but that headroom will likely run out sometime this fall.

As soon as Congress returns from recess in September, lawmakers and the President should enforce further discretionary budget cuts while protecting national security and implementing entitlement reforms. Doing so would avoid a debt crisis this year and in the future.

Fixing the nation’s spending and debt crisis this fall is not just a convenient opportunity. It’s a national obligation.