After shimmying up trees and doing away with storm debris, the obviously able-bodied tree trimmer asked his customer, “Could you make the check out to my mom? I’m on disability.” Inconveniently for him, the tree trimmer’s customer was Senator Tom Coburn (R–OK).

This guy asked a U.S. Senator to help him defraud the Social Security Disability program.

In fact, Coburn is one of the last legislators you want to let in on such a scheme, having built a reputation of going after waste, fraud, and abuse. After witnessing the man shimmy up trees while collecting government disability benefits, Coburn wondered, “How widespread is the abuse?”

Wide.

An 18-month investigation by a Senate subcommittee reports that in more than 25 percent of cases reviewed, evidence confirming disabilities was “insufficient, contradictory, or incomplete.” The staff reviewed 300 decisions in which individuals were awarded disability benefits by administrative law judges. A 2011 internal Social Security Administration report echoed the findings, showing a national error rate of 22 percent.

Coburn, a medical doctor, personally reviewed the application and evidence in 100 individual cases. His summation was even more startling: “In about 75% of the cases I went through, people were not truly disabled.”

Enormous inconsistencies emerged after looking at how judges reviewed evidence. Coburn said, “you could flip a coin for anybody that came before the Social Security commission for disability and get it right just as often as the judges.”

A recipient’s award is not chump change, averaging $1,111 per month and $300,000 over the course of a lifetime. In addition, after a 24-month waiting period, SSDI beneficiaries qualify for Medicare benefits. In SSDI, disabilities include a range of problems, but about one-third of the diagnoses are mental disorders.

Giving disability payments to people who don’t need it is outrageous on many levels. Not only is it criminal, but it offends our sensibilities of fairness, runs counter to the American work ethic, and fuels the coming bankruptcy of a very important safety net program.

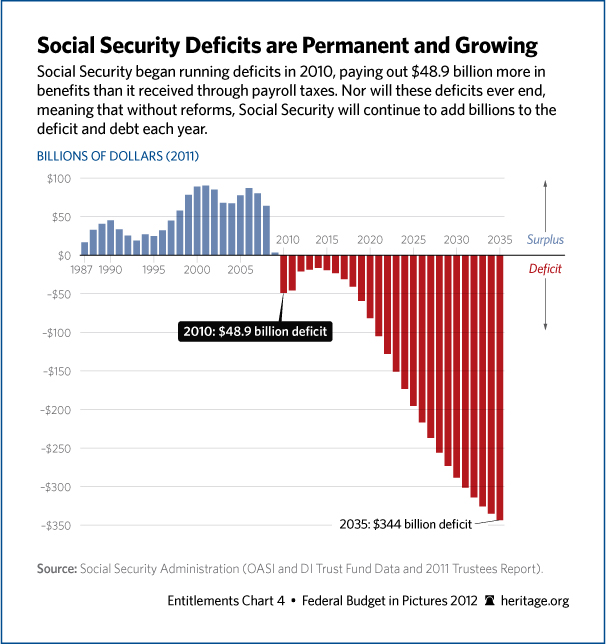

In April, the 2012 Social Security trustees’ report projected that the disability trust fund will be exhausted in 2016—two years sooner than last year’s report and sooner than any other federal entitlement trust fund.

The program’s precarious financial footing has accelerated in the last five years because of an astounding 23 percent increase in those on the rolls, bringing the total to 11 million beneficiaries. The surge is not simply a result of baby boomers reaching their disability-prone years. It’s the economy. People are losing their jobs and making a run for disability support. In fact, Heritage analyst James Sherk reports that the rise in SSDI rolls accounts for about a third of the drop in labor force participation between 2007 and 2011; overall, six percent of the country’s adult population say they are not working due to a disability.

Action is needed. The Social Security Disability Income program is meant to provide a safety net to one of our most vulnerable populations—individuals with disabilities who can no longer work. It supports the neighbor coping with severe brain injury from a car accident and the family member whose multiple sclerosis has progressed to a stage where work is no longer possible. We value and believe in such a safety net.

Congress needs to find solutions; Senator Coburn laid out a series of steps the agency can take to improve the reliability of judges’ disability decisions.

That will not be enough to save the program, however. For the larger problems, Congress needs to reform entitlements and enact pro-growth policies similar to those proposed in The Heritage Foundation’s Saving the American Dream. As Heritage expert David John notes, “modest changes will not fix the current system.” Boldness in fighting fraud and reforming entitlements is needed.