Even Krugman Agrees–Economy in a Dead-Cat-Bounce Recovery

J.D. Foster /

Despite a recent spate of good economic data, including last week’s jobs report, the U.S. economy remains deeply depressed. Don’t take my word for it. That’s how Paul Krugman, leftist econo-pundit extraordinaire, describes the economy. In a recent column in The New York Times, he wrote, “our economy remains deeply depressed.”

As Krugman pointed out, given an honest appraisal, one finds that “every silver lining comes with a cloud.” And thus it is with the recent good data, which while decidedly good and will hopefully persist, nevertheless cannot disguise the fact that we’re in a deep hole and not climbing out very fast.

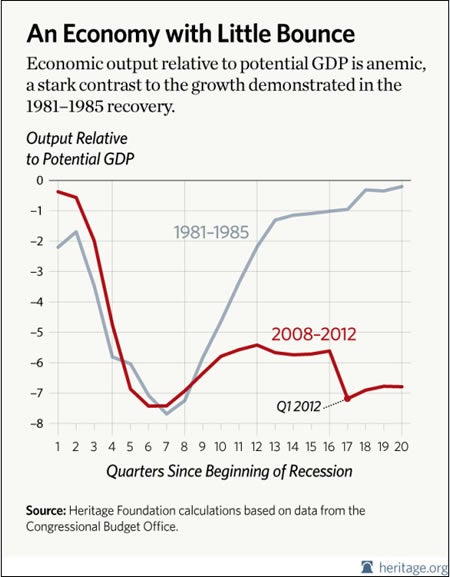

What could justify Krugman’s assessment of the economy? Just look at the cloud. Compare the current recession and recovery with the last deep recession from 1981 to 1982 and the subsequent recovery. A natural comparison is to show how far the economy is operating below its potential.

Potential output may be an unfamiliar concept, but a good analogy is the level of full employment. The general view is that the economy is at full employment when the unemployment rate is around 5.5 percent. The latest jobs report pegged the unemployment rate in December 2011 at 8.3 percent. So the unemployment rate is far above full employment, just as potential output is far higher than actual output.

Fortunately, the Congressional Budget Office (CBO) provides a reasonable historical estimate and projection for potential gross domestic product. Using this series compared to actual output and CBO’s projections for 2012 and 2013 yields the neighboring graph: (article continued below chart)

Remarkably, the recession that began in 1980 looks a lot like the recession that began in 2008. Both featured very rapid contractions lasting almost two years, the total amount of contraction was very similar, but there the similarities end. Once the economy hit bottom in 1982, it recovered almost as fast as it had fallen, so after two years of recession and two years of recovery, the economy was almost back at its potential by 1984, or near full employment.

No such luck this time. Instead of a strong, sustained recovery, we’ve got a dead cat bounce recovery: some initial improvement and not much after that. And the CBO forecast for 2012 and 2013 shows precious little improvement after that.

Yes, the economy is growing. It has grown for 10 straight quarters—but at a very pedestrian 2.4 percent annual rate. Coming out of the last comparably deep recession, the economy grew at an average annual rate of 6.5 percent for the first two years of recovery.

Sure, the economy is facing some uniquely difficult issues today. But it did in 1981, as well. Different issues, to be sure, but no less alarming—including recovery from Jimmy Carter’s malaise, frighteningly high inflation followed by a daunting disinflation, a Cold War that was heating up, and a general Carteresque sense that America’s best days were behind us.

The real difference between then and now is that President Reagan put in place policies that unleashed the economy from some of its Washington shackles. In contrast, President Obama has loaded up the economy with more government debt, more regulations, and—worse—more gray uncertainty about the future.

Lloyd Bentsen, then a Senator running for Vice President with Walter Mondale, once turned to Dan Quayle in a debate after Quayle had referenced John F. Kennedy and famously said, “Jack Kennedy was a friend of mine. You’re no Jack Kennedy.” Is it unfair to point out that Barack Obama is no Ronald Reagan when it comes to economic policy and results? No, it’s precisely the point.