In Pictures: How Much the Top Earners Already Pay in Taxes

Mike Brownfield /

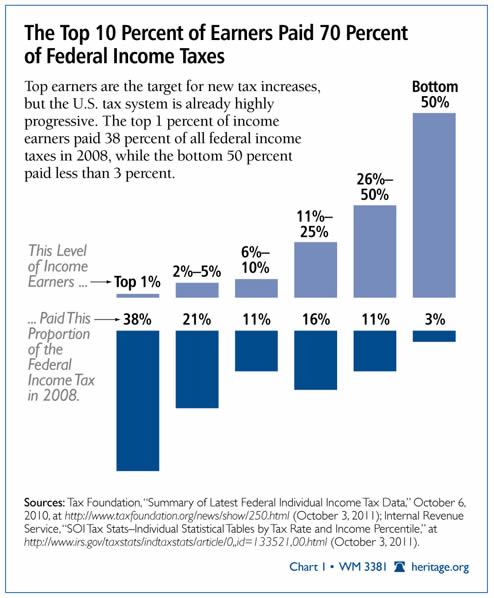

America has heard a lot of talk about the “Buffett Rule” — President Barack Obama’s plan to make the tax code more “fair” by permanently raising taxes by $1.5 trillion over 10 years, with most of the burden falling on families and businesses earning more than $250,000 per year. But if he wants to talk about “fairness,” he should look at how much top income earners already pay in taxes, as the chart below shows:

In a new paper, Heritage’s Curtis Dubay explains that the supposed “fairness” of the new rule is anything but fair:

To President Obama, it is “fair” to raise taxes on families and businesses earning more than $250,000 a year by raising their income tax rates and limiting their deductions. That must also mean he believes that they currently pay too little in taxes.

Yet the data show the highest-earning families and businesses already pay the lion’s share of the federal income tax burden. According to the IRS, the top 1 percent of income earners—those earning more than $380,000 in 2008—paid more than 38 percent of all federal income taxes while earning 20 percent of all income. The top 10 percent ($114,000 and above) earned 45 percent of income and paid 70 percent of all taxes. At the same time, the bottom 50 percent of income earners—those earning less than $33,000—earned 13 percent of all income and paid less than 3 percent of federal income taxes.

Read more of Dubay’s paper, “The Buffett Rule: Fair to No One,” at Heritage.org.