What Moody’s Really Told Boehner and Obama about the Debt Ceiling

Alison Acosta Fraser /

Everyone’s heard that Moody’s has threatened to downgrade our bond rating unless the debt ceiling is raised. We get that—crisis pending, yada, yada, yada. But if you read the announcement closely, there are important new points they added to the mix.

First, Moody’s really doesn’t believe–that the President really will let Geithner default on our Treasury bonds—despite all of President Obama’s foot-stamping, scaremongering, and high stakes “This may bring my Presidency down” retro-drama.

Moody’s says that “there is a small but rising risk of a short-lived default” (emphasis added), that “the probability of a default on interest payments is low,” and that principal and interest “have always been paid on time,” even though some past debt limit debates have “been contentious.”

This tells us that they have confidence that in the end that the federal government will not default on the debt, though there may be some tense moments over the next few weeks or so.

But the second issue is where it gets interesting. And here is where House Speaker John Boehner (R–OH) and Obama need to pay attention.

The real future of our bond rating depends less, in their view, on the timing of a debt limit resolution—which they believe is inevitable—than on the substance:

The outlook assigned at that time to the government bond rating would very likely be changed to negative at the conclusion of the review unless substantial and credible agreement is achieved on a budget that includes long-term deficit reduction. To retain a stable outlook, such an agreement should include a deficit trajectory that leads to stabilization and then decline in the ratios of federal government debt to GDP and debt to revenue beginning within the next few years.

This means Congress and the President must bring down the deficits and debt, which must then begin to stabilize. And the key part is that any legislation must start those steps right now.

So Boehner and Obama must deliver major, substantive, transformational changes in the budget that are real—no gimmicks, gents—that begin to take effect immediately and sustain and grow automatically over the long term—no back-loaded cuts that can be easily waived at the next opportunity.

Moody’s will be doing its debt downgrade tango if debt ceiling legislation doesn’t deliver a plan that fundamentally reshapes the nation’s finances to put an end to our Greek debt formula.

Just how big do the changes need to be to produce a “decline in the ratios of debt to GDP and debt to revenue”?

Consider Obama’s published budget (not the fake, speechified proposal), which would add $10 trillion to the debt. Any legislation leading to a decline in the debt-to-GDP ratio would have to make a major dent in the debt increase.

One option that is rapidly gaining traction in the Senate is the bizarre McConnell proposal, which would result in nebulous proposals for around $2.5 trillion in cuts, which Congress can easily ignore after Obama (not Congress) raises the debt ceiling. Hmmmm, immediate cuts? Nope. Definitely cuts spending? Nope. Smoke and mirrors? Yep. So that doesn’t pass the Moody’s test. But let’s set these flaws aside for now.

McConnell’s maximum possible cut would result in only a 25 percent reduction in Obama’s scheduled $10 trillion increase. Debt would still grow by $7.5 trillion, an increase in excess of 50 percent (over 10 years). And it’s a big “if” that those cuts would ever materialize. So, hardly scoreable, certainly not enforceable, and impossible to judge how the cuts would play out beyond the 10-year budget window because there are no cuts to score! And no deal to enforce!

For $2.5 trillion in savings to work against the Moody’s debt downgrade tango, savings must be scoreable by the Congressional Budget Office—or spending caps must be enacted that have explicit enforcement mechanisms and will lead to further budget savings as reforms take hold and become robust. Bye-bye, gimmicks. If Moody’s had been doing the debt downgrade tango during Obamacare, those phony budgetary gimmicks would have dropped our credit rating faster than a porcine partner on the dance floor.

No, the kind of changes necessary that would stabilize the debt can be found in “Saving the American Dream: The Heritage Plan to Fix the Debt, Cut Spending and Restore Prosperity.” Our plan balances the budget in a decade and keeps it balanced thereafter—without raising taxes. By 2035, debt held by the public is at 30 percent of GDP and falling.

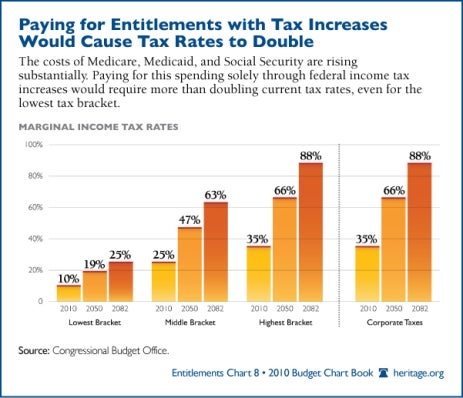

Obama, on the other hand, wants to raise taxes to solve all or part of the debt crisis. But without fundamentally altering the spending trajectory (the one he would willfully worsen), either taxes would have to rise constantly or else our debt would continue to mount.

And for the debt to stabilize, the economy needs strong growth in addition to spending cuts. Just how that would happen under Obama’s tax hike solution—especially when it is languishing with 9.2 percent unemployment today—is never explained. It’s very hard to see how tax hikes would truly meet the test of the debt downgrade tango.

So, in the final analysis, what Moody’s is really telling Boehner and Obama, through its broadcast to the world, is that there must be transformational changes in spending that will put this nation on the right course and keep it there. And those changes must happen now.

So, Mr. President and Mr. Speaker: Let’s get this thing done.