The Breakdown of Where Your Tax Dollars Go

Romina Boccia /

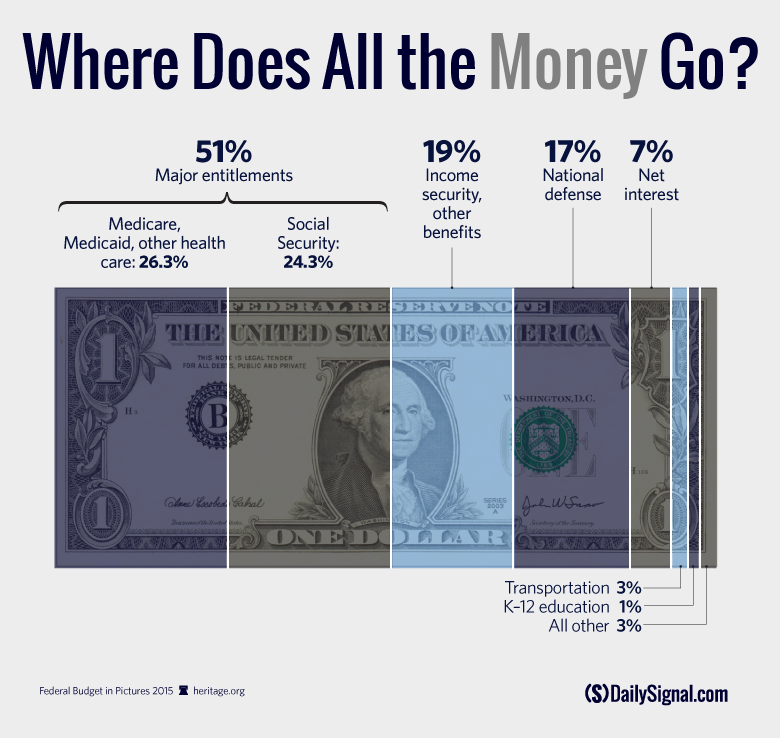

Tax dollars paid for about 85 cents of every dollar spent in 2014—the rest was borrowed. Where did all that money go?

Your 2014 tax dollars—which are due next month—went primarily to pay for government benefits.

Major entitlements (Medicare, Medicaid, Obamacare and Social Security) devoured more than half of the 2014 budget at 51 percent of spending. Other federal benefits took another 19 percent, meaning that 70 percent of government spending went to pay some sort of benefit to someone. These additional “income security” and other benefits include federal employee retirement and disability, unemployment benefits, and welfare programs such as food and housing assistance.

Obamacare spending really only kicked in for the first time in 2014. But Obamacare spending alone is expected to grow the major entitlement budget by 44 percent over the next decade. All in all, the total spending increase due to Medicare, Medicaid, Obamacare, Social Security and interest on the debt over the next decade is 85 percent. This means that the share of the budget going to entitlement programs will grow even bigger if Congress doesn’t act.

Congress should repeal Obamacare and make common-sense reforms that modernize these outdated entitlement programs. That’s hard, but important work. Common sense reforms will both modernize Medicare, Medicaid and Social Security and empower people to exercise more choice in spending their health care and retirement dollars.

Check out the 2015 Federal Budget in Pictures for 21 charts on spending, debt and taxes today!