Social Security COLA: How to Improve Accuracy and Stop Excess Spending

Romina Boccia / Michael Sargent /

Time for some simple math: Which poll will more accurately determine the effect of a change on a whole group—one that surveys three of 10 people, or one that surveys nine of 10? While this may seem like an easy question, the Social Security Administration (SSA) currently receives a failing grade on this quiz for using an outdated index to determine its cost-of-living adjustment (COLA). With today’s announcement of the COLA for 2014, let’s take a closer look at how it was determined.

The SSA uses an index that accounts for the habits of 32 percent of the population—despite the existence of a newer index that evaluates those of 87 percent of people. Congress has failed to implement an improved index that yields greater accuracy: the chained consumer price index (C-CPI). Congress has not made any changes to Social Security in 30 years. The program is long overdue for reform, and implementing the chained CPI for COLAs is only the first step.

Regular COLAs began in 1975, ensuring that retirees’ checks don’t fall behind in real dollar value as the cost of consumer goods rises. This assurance gives Social Security beneficiaries the same purchasing power each year, as opposed to the system prior to 1975 in which benefits remained flat for a number of years, and actually fell with inflation, until Congress got around to adjusting benefits.

So what’s the problem? The problem is the current inflation measurement, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W, used unaltered since 1975, only takes into account price changes experienced by one-third of Americans. In addition, the CPI-W fails to consider shifts in consumer spending habits as prices change, causing it to overstate the impact of inflation on beneficiaries and leading to excess payments.

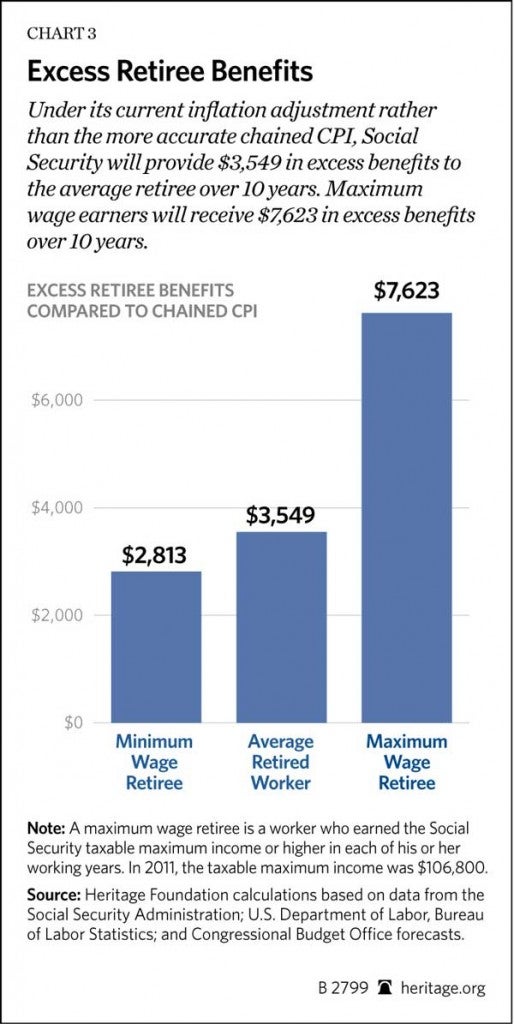

To avoid these excess payments, the SSA should replace the CPI-W with the chained CPI, which takes into account the prices paid by all urban workers—a demographic that covers 87 percent of Americans. The nonpartisan Congressional Budget Office has stated that the chained CPI “provides a more accurate estimate of changes in the cost of living from one month to the next.”

Making this change not only improves accuracy, but would also save the SSA about $130 billion over 10 years—all without cuts and while still increasing benefits to match inflation. As Social Security is now in its fourth year of running cash flow deficits and beneficiaries face an automatic 23 percent benefit cut no later than 2033, this reform is an especially important step toward fiscal responsibility.