Social Security Benefits and Cost of Living: Protecting Against Inflation

T. Elliot Gaiser /

Adopting the chained CPI (Consumer Price Index) in Social Security to more accurately account for changes in the cost of living is a small first step toward fixing a broken program that is currently accelerating its own demise by paying excess benefits.

Fifty-seven million Americans receive Social Security benefits, and many live on these benefits alone. It is imperative that Congress reform the system well before automatic benefit cuts decimate the benefits of retirees in need. One reason the system is in trouble is that the Social Security Administration is paying cost-of-living adjustments (COLAs) based on an outdated and inaccurate index that overstates changes in the cost of living.

COLAs based on the chained CPI would still increase benefits to keep pace with inflation over the next decade: by $197 for someone who retires after a lifetime earning the minimum wage, by $248 for average wage earner retirees, and by $533 for maximum taxable wage earner retirees. But without reform, Social Security will pay out excess benefits. As Heritage’s Romina Boccia and Rachel Greszler write in a new Heritage report:

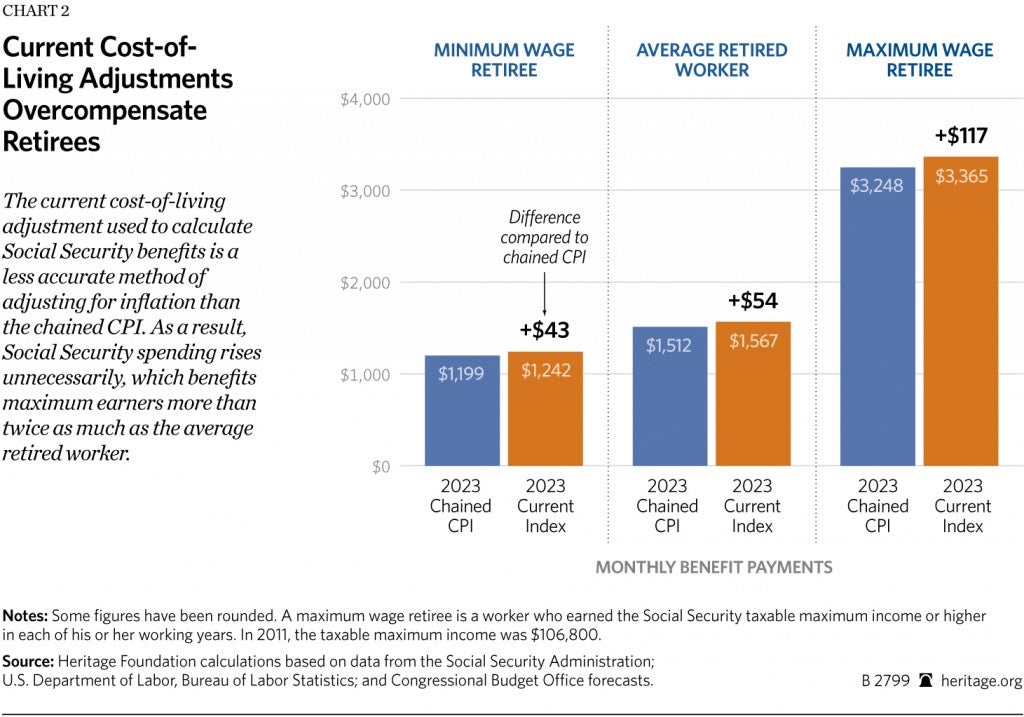

Compared to a more accurate inflation adjustment, current benefit payments will result in an additional $43 per month by 2023 for a minimum wage worker retiring in 2013, an additional $54 per month for the average retired worker, and an extra $117 per month for a maximum wage earner retiring in 2013. These benefits are in excess of what is needed to maintain beneficiaries’ purchasing power after inflation.

Most of the excess benefits from the current, inaccurate COLA index go to the highest earning recipients, while those who earned the minimum wage benefit the least from overstating inflation. Using the chained CPI would correct this excess while more accurately protecting beneficiaries from changes in the cost of living.

Lower-income retirees would suffer the most from Social Security’s across-the-board benefit cuts if Congress fails to reform the program’s finances. Excess payments under today’s inaccurate COLA only accelerate this deadline. As Boccia explained:

Using an incorrect inflation measure is a poor strategy to assist these populations. Instead, a minimum flat benefit level that ensures that no senior falls into poverty in retirement, as proposed in the Heritage plan Saving the American Dream, would be much more effective at assisting seniors in need.

By eliminating costly excess payments while keeping benefits on pace with inflation, the chained CPI could solve a fifth of Social Security’s funding shortfall and save the program close to $130 billion over the next decade. Lawmakers should view this policy as a wise first step toward broader social security reform.